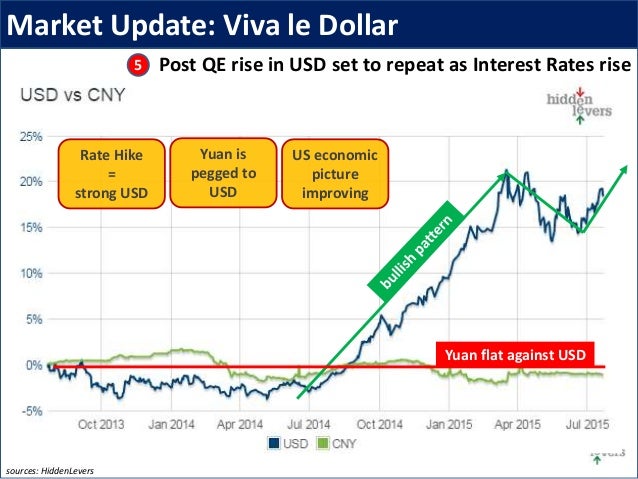

The bad news is that stronger currencies hurt exports. It is estimated that the US GDP lost $19 billion in exports during the first quarter and at least twice that much in the second quarter. With the yuan tracking the dollar, that means Chinese exports are getting slammed as well. The difference is that the US economy is strengthening and can absorb the impact on its exports, while the Chinese economy is weakening and cannot absorb the impact nearly as well.

The US has 25% of the world’s GDP. China has the second largest share of world GDP at 15%. While their growth rate is higher than ours, the difference is decreasing slightly, and the stronger dollar is helping to reduce that difference.

The question is how long will China maintain this link between the yuan and the dollar?