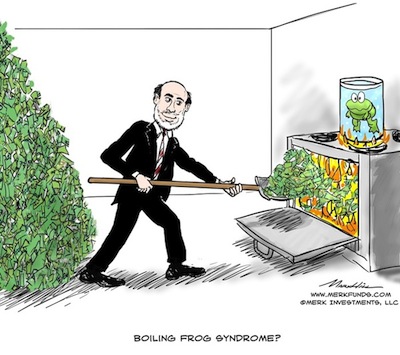

If a picture is worth a thousand words, how much is a cartoon worth? Take a look at this one, which has more humor than truth:

It shows Fed Head Ben Bernanke shoveling a huge pile of existing cash into a fire, where it is destroyed forever. It makes the point that the average American is unaware the problem is increasing, just as a frog will be peacefully cooked-to-death when the water temperature rises slowly enough.

It is true that the average American is not panicking. (But, then again, the average American doesn’t over-react nearly as much as the average investor does.)

However, is it fair to say Bernanke is destroying a existing pile of cash or wealth? To answer that, it is necessary to look at the accounting.

The Treasury (not the Fed) needs to spend money for Social Security payments, as an example. Of course, the Treasury needs cash to cover all those checks. To get cash, they issue Treasury bonds. (Normally, investors like pension funds were the biggest buyers. China has also bought about $1.2 TRILLION of Treasury bonds. Today, the Fed buys about 75% of all bonds issued by the Treasury Department.)

When the Fed buys the bonds from the Treasury, it credits its books with new assets purchased (the bonds) and credits the checking account of the Treasury with cash. So far so good — the Fed has bought AAA-quality bonds, and the Treasury now has brand-new cash to pay Social Security checks. However, note there was no huge pile of existing cash. The Fed simply manufactured or “printed” it.

Someday, the Fed will want to start reducing the amount of cash it has put into the economy. To do that, they will start selling the bonds it holds on its balance sheet — selling them to more traditional investors or foreigners. The accounting is that the Fed debits bonds owned on its balance sheet and debits cash owned by the new bond buyer — sucking cash out of the bond buyer’s checking account and therefore out of the economy.

Of course, that will not happen until the Treasury stops selling more bonds than there is demand for those bonds from those same traditional investors and foreigners. (It is a theoretical but inconceivable scenario that the Fed would attempt to sell them too soon, which would cause chaos in the market – don’t worry about that scenario!)

But, why has the already huge increase in the money supply NOT raised the temperature enough to cause inflation or at least to start warming-up the frog?

Skipping the formulas, the reason is that nothing is being done with the new money. It is not being spent and has no “multiplier” effect. According to the Keynesian economists, the increased saving by consumers reflects how shell-shocked consumers were during the last recession. According to Monetarists, it is the banks who are not lending, instead of the consumers who are not spending. Of course, the data suggests both are right, but the trend is changing. Consumers are now showing more interest in spending than banks are in lending.

When this newly-created money by the Fed is no longer “dead money,” the frog will be in trouble!

Stay tuned . . . I’ll let you know before that happens . . .

When the Fed buys the bonds from the Treasury, it credits its books with new assets purchased (the bonds) and credits the checking account of the Treasury with cash. So far so good — the Fed has bought AAA-quality bonds, and the Treasury now has brand-new cash to pay Social Security checks. However, note there was no huge pile of existing cash. The Fed simply manufactured or “printed” it.

Someday, the Fed will want to start reducing the amount of cash it has put into the economy. To do that, they will start selling the bonds it holds on its balance sheet — selling them to more traditional investors or foreigners. The accounting is that the Fed debits bonds owned on its balance sheet and debits cash owned by the new bond buyer — sucking cash out of the bond buyer’s checking account and therefore out of the economy.

Of course, that will not happen until the Treasury stops selling more bonds than there is demand for those bonds from those same traditional investors and foreigners. (It is a theoretical but inconceivable scenario that the Fed would attempt to sell them too soon, which would cause chaos in the market – don’t worry about that scenario!)

But, why has the already huge increase in the money supply NOT raised the temperature enough to cause inflation or at least to start warming-up the frog?

Skipping the formulas, the reason is that nothing is being done with the new money. It is not being spent and has no “multiplier” effect. According to the Keynesian economists, the increased saving by consumers reflects how shell-shocked consumers were during the last recession. According to Monetarists, it is the banks who are not lending, instead of the consumers who are not spending. Of course, the data suggests both are right, but the trend is changing. Consumers are now showing more interest in spending than banks are in lending.

When this newly-created money by the Fed is no longer “dead money,” the frog will be in trouble!

Stay tuned . . . I’ll let you know before that happens . . .