Our younger brethren argue that this is simplistic, in that other factors come into play. AGREED!

They argue that it has broken down entirely since the global financial crisis. AGREED!

They argue that the curve is not static but moves constantly. AGREED but the relationship stays!

They argue that it cannot be proven mathematically. AGREED, but you cannot prove the existence of God mathematically either.

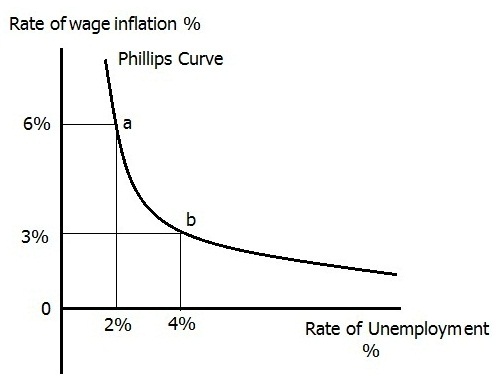

The important thing is — that the Phillips Curve still frames policy discussion. Intuitively, it makes sense to me that inflation can be dampened by driving up unemployment, which removes spending power in the economy. You can do this by raising interest rates. This is exactly what Fed Head Paul Volcker did. In March of 1983, inflation reached a nosebleed level of 14.8%. Volcker drove up interest rates to a terrifying 20%. The prime interest rate was 21.5%, and unemployment soared to 10%. The economy promptly went into recession, but inflation fell to a mere 3% by 1983. In the short-term, Volcker was condemned for putting the burden of ending inflation on the backs of the working poor. In the long-term, he has been hailed as courageous.

Now, what should Chair Yellen do today, when neither unemployment nor inflation are problems?

Young economists say that proves the Phillips Curve is irrelevant, since neither unemployment nor inflation are problems. It is irrelevant only inside the bubble that has existed since 2008. As economic conditions normalize, with higher interest rates and lower budget deficits, it will become increasingly relevant. Of course, exactly when will that happen?